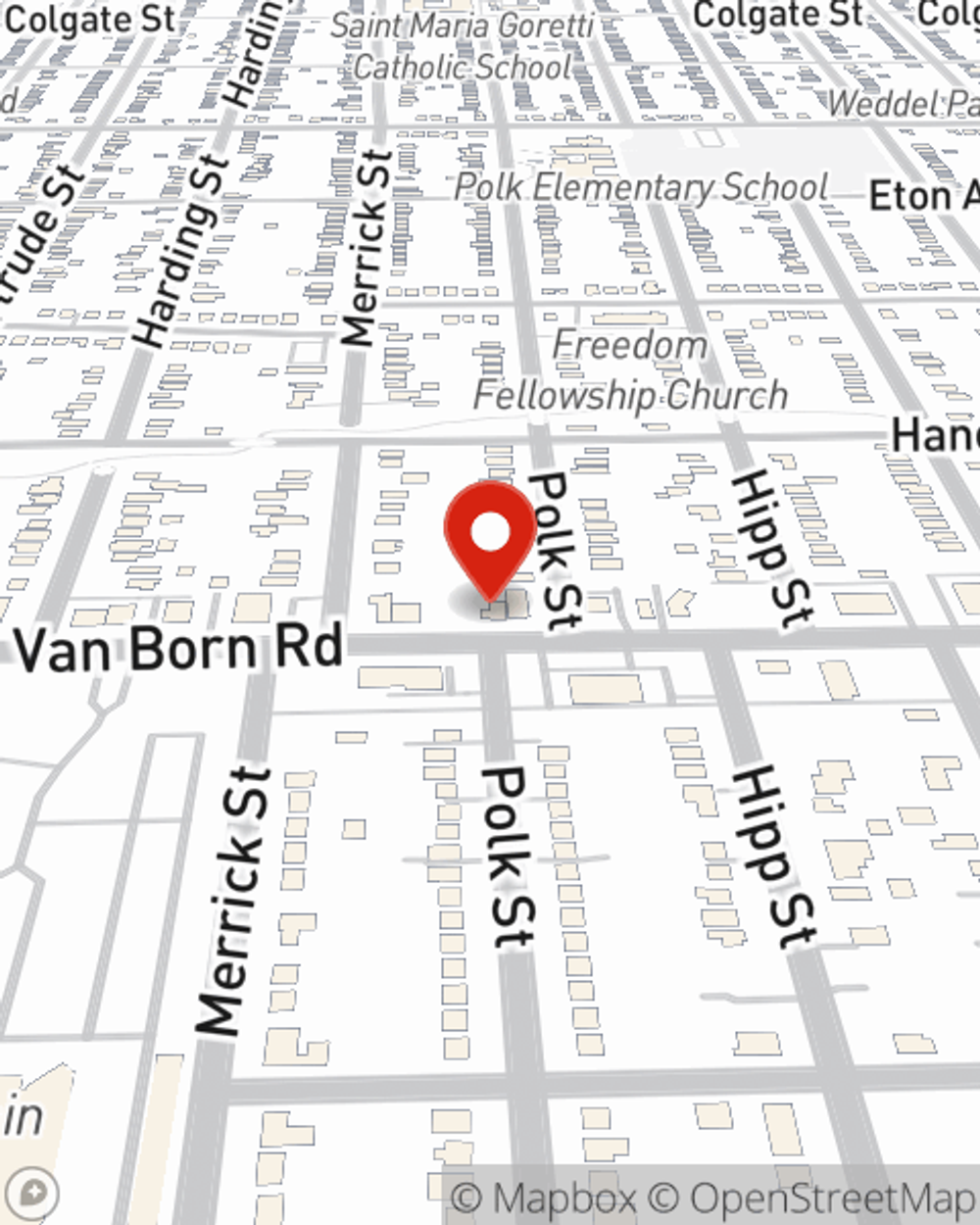

Insurance in and around Dearborn Heights

Great insurance with your good neighbor

Protect what matters most

Would you like to create a personalized quote?

It’s All About You

Everyone loves saving money. Personalize a coverage plan that helps protect what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts*, you can create a solution that’s right for you. Contact Jeff Samford for a Personalized Price Plan.

Great insurance with your good neighbor

Protect what matters most

Insurance Products To Meet Your Ever Changing Needs

As the largest insurer of automobiles and homes in the U.S., State Farm is equipped and experienced when it comes to helping you protect the life you've built with competitive prices, great claims service and excellent service.

Simple Insights®

Preparing a living will and end-of-life care choices

Preparing a living will and end-of-life care choices

Find out how preparing a living will ensures your wishes are honored if you are unable to speak for yourself.

Why your dog needs health insurance

Why your dog needs health insurance

Dog health insurance allows you to take care of the health needs of your dog throughout its lifetime.

Jeff Samford

State Farm® Insurance AgentSimple Insights®

Preparing a living will and end-of-life care choices

Preparing a living will and end-of-life care choices

Find out how preparing a living will ensures your wishes are honored if you are unable to speak for yourself.

Why your dog needs health insurance

Why your dog needs health insurance

Dog health insurance allows you to take care of the health needs of your dog throughout its lifetime.